On the price of oil

Michael Hillman

(1/2015) Americans got a much-appreciated Christmas present this year in lower gas and heating bills, thanks to the collapse in the price of oil. It wasnít too long ago that drivers were facing the threat of $5 a gallon for gasoline, forcing many to choose between vital necessities or

filling their cars with gas. Unfortunately, due to our urban lifestyle, gas was winning out Ė and in doing so, sucking the fun out of life for many.

(1/2015) Americans got a much-appreciated Christmas present this year in lower gas and heating bills, thanks to the collapse in the price of oil. It wasnít too long ago that drivers were facing the threat of $5 a gallon for gasoline, forcing many to choose between vital necessities or

filling their cars with gas. Unfortunately, due to our urban lifestyle, gas was winning out Ė and in doing so, sucking the fun out of life for many.

Now that weíre in a breather, itís worth stepping back and looking at the causes of the run up and subsequent collapse of the price of oil, for understanding this is the first step in hopefully preventing a repeat of the last five years of high oil prices. For decades the price of oil was

dictated by market factors of supply and demand. As demand increased, the price rose. As the price rose, new sources of oil, e.g. the Gulf of Mexico, the North Sea, etc. were found and brought on line. Thus, the resultant increase on supply stabilized the price of oil.

In 1960, when the Organization of the Petroleum Exporting Countries (OPECs) was formed, oil was selling at $3/barrel. At the time, the US was the largest producer of oil, so OPEC, which was at the time comprised of Iran, Iraq, Kuwait, Saudi Arabia and Venezuela, had little influence on the

prices of oil.

By 1971, the addition of Qatar, Indonesia, Libya, United Arab Emirates, Algeria and Nigeria resulted in the shifting of the balance of production away from the US to OPEC. During the Yom Kippur War of 1973, OPEC exploited itís new found strength and ceased selling oil to the west, resulting

in drop in supply. To keep the price of gas from jumping at the pump, the US Government implemented gas rationing for the first time in peacetime history. Public frustration, with long lines at gas stations, resulted in a call for America to become energy independent. It worked. The supply of oil rose and the price

once again stabilized.

Events during 1979 involving the Iran revolution and Iraq-Iranian war saw crude oil production fall another 5.3 million barrels, almost a 1/8 of total world production. The combination of these two events resulted in crude oil prices more than doubling from $14 to $35 per barrel. The sudden

spike in the price threw the US and Europe into recession.

In 1982 OPEC, for the first time, set production quotas for each country member to stabilize oil prices. While members frequently cheated on their production quotas, the plan worked and for the next 23 years the price of oil remained stable.

Government programs in 2005 began to expand homeownership beyond the traditional homeowners which sparked a housing bubble. With the price of homes seen as a one-way bet, everyone wanted into the game. The explosion in economic activity drove an increase in the demand for oil and the price

of oil began a steady march upwards. In 2008, the price of oil reached an all time high of $126/barrel. The following month the stock market crashed under the weigh of the high cost of oil. With economic activity coming to a standstill around the world, the price of oil collapsed almost overnight, dropping to $32

by that December. This was clear proof that the law of supply and demand works.

But, the law of supply and demand only works as long as Governments donít interfere. They interfered in the housing market and we got the financial collapse. To address the price of oil collapse, they interfered again, this time with a monetary policy called Quantitative Easing.

The drop in interest rates as a result of Quantitative easy was a boom for over stretched homeowners who suddenly found themselves able to refinance homes at much lower interest rates. But, with the Federal Reserve running their printing press in overdrive, the value (purchasing power) of

the dollar, which oil is priced in, fell. As a result, oil producers began to ask more for each barrel of oil. Once more the price of oil was soon in an upwards spiral, and before anyone knew it, drivers were faced with $4 gas. In spite of all the efforts of the Federal Reserve, the US economy was once again

sputtering under the high price of oil.

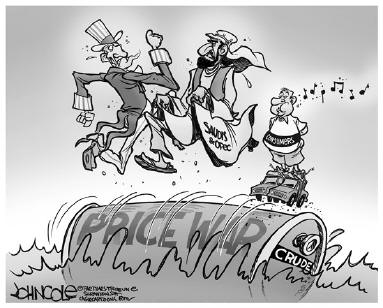

However, the law of supply and demand came to the rescue. The high price of oil spurred the Shale Oil boom in the US. As US production rose, the supply side of the equation became more balanced. Historically, that would be the end of the story. A new supply of oil coming on line would

stabilize oil prices and a new equilibrium would be established, and gas prices would settle in the $4 range. But all things were not equal.

With the US economy appearing to hit on all cylinders, the Federal Reserve finally ended Quantitative easing this year Ė turning their printing presses off for the first time in 5 years. At the same time, Europe and China and turned on their printing presses in hopes of reinvigorating their

flagging economies, resulting in the value of the dollar relative to all other currencies to rise. As the value of the dollar rises, the amount of oil it buys increases, resulting in a drop in the price of oil. Add in the decrease in oil demand due to the faltering economies in Europe and Asia, and the oversupply

due to US shale oil production, and the price of oil suddenly became a one-way bet Ė down.

Now you would think the collapse in oil and the resultant drop in the price of gas at the pumps would be good for the stock market, but instead, it has shaken the financial markets. Many of the shale oil producers borrowed heavily to finance their operations based upon an ever-increasing

price of oil. (Sound familiar? Itís the housing crisis of 2008 all over again.) With the price of oil now below their breakeven level, many are facing bankruptcy. Now add in the failing European and Asian economies and things just donít look as rosy as you would hope.

On the upside, with all the new oil production capability now available, itís a safe bet that low oil prices are here for a while and consumers can take a break and rebuild their tattered balance sheets.

One, however, can only wonder what would have happened had market forces been allowed to take their natural course following the collapse of the housing bubble in 2009. Yes it may have been bloody for a while, but that is all part of Creative Destruction, a term coined by economist Joseph

Schumpeter to describe how capitalistic economies naturally shift resources allowing society as a whole to enjoy a rise in overall quality of life. Itís time to return those principles. Only then will we get our economy back on solid ground.

Read other articles by Michael Hillman