Shannon Bohrer

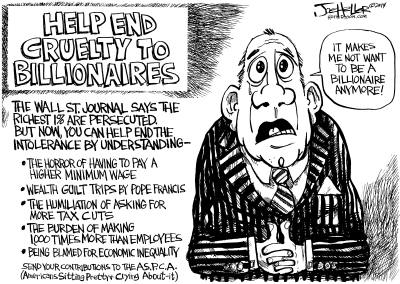

(4/2014) A common complaint within some segments of the press is that the government is trying to redistribute the wealth. Apparently some people actually believe that the government is about to do thisó because of the reported income inequality that has

also been in the news. With the reporting there has also been some press coverage of a Mr. Perkins, who happens to be a billionaire. It seems that Mr. Perkins has equated the treatment of wealthy people in America to the Nazi attacks on Jews just before the Holocaust. He wrote that in a letter that was published in the Wall Street Journal. I am a student of history and I just

do not see the connection. Does he really think we have concentration camps for the wealthy and that the government wants to take his wealth?

(4/2014) A common complaint within some segments of the press is that the government is trying to redistribute the wealth. Apparently some people actually believe that the government is about to do thisó because of the reported income inequality that has

also been in the news. With the reporting there has also been some press coverage of a Mr. Perkins, who happens to be a billionaire. It seems that Mr. Perkins has equated the treatment of wealthy people in America to the Nazi attacks on Jews just before the Holocaust. He wrote that in a letter that was published in the Wall Street Journal. I am a student of history and I just

do not see the connection. Does he really think we have concentration camps for the wealthy and that the government wants to take his wealth?

While a lot has been printed and said about redistribution of wealth, there has also been a lot said and written about the 1 percent. The 1 percent being the wealthiest individuals in our society. Mr. Perkins is in the 1 percent, which is a good place to be. During 28 years, ending in 2007, the average after-tax income for the top 1 percent increased

by 275 percent. At the same time there was an increase of 20 percent for the bottom 20 percent. Apparently the top 1 percent are doing very well with some doing extremely well. The heirs to Wal-Mart are in the group doing extremely well and are worth a reported $89.5 billion. For a clear perspective, $89.5 billion is equivalent to the wealth of almost 49 million households.

The heirs include six people.

According to a report by Credit Suisse (a Swiss bank) there were 98,700 individuals, worldwide, with net worth more than $50 million, with more than half of them in the United States. It was also reported that the top 10 percent of U.S. earners control two-thirds of American wealth. There has been an inequality in the distribution of incomes over time.

In 1982 the top 1 percent of earners earned 12.8 percent of the total national income and by 2006 they earned 21.3 percent. And in a strange coincidence this distribution difference has not been seen since the Depression era. In 2013 in American the top 1 percent took in an average of $1.3 million per year, while the average American earns just $33,000 per year.

You would think that Mr. Perkins would be happy since the United States has more income and wealth inequality than many countries and that would seem to affect him in a positive way. But just how the rich got richer is a good question and there have been multiple theories in the public conversation. One theory is that they are just paid more. If we

examine the 299 companies in the S&P 500 Index, thirty years ago the CEOís average compensation was 42 times that of the average worker. In 2010, the CEOís average compensation was 343 times more than the average worker. The CEO makes an average of $11.4 million and the average worker made $33,190. From 42 times to 343, that is a big jump.

Another theory is that the one percent is just smarter, they work harder and they have just risen to the top because of their talent. That sounds good until you realize that this country has always had talented individuals that have risen to the top, but the wealth has not always been concentrated so much in so few. However, there have been times when

the wealth distribution was as great. During the late 1800ís when the Robber Barronís owned and ran everything was one of those times. Of course it was easier then because the rich had no regulations to comply with. Thatís why monopolies existed until the government created regulations. Of course there was a lot of opposition to the regulations; after all they were viewed as

"job killers." Then just before the Great Depression there was another period of great wealth inequity. This time many the wealthy ran the financial institutions and when they collapsed we had a depression, a big one.

Another theory is that the widening the income inequality between the rich and poor is related to tax policies that benefit the rich. Reportedly the tax policies have been favoring the rich for over thirty years. I am sure this theory has legs since many of the wealthy have influence in congress. Every time a politician says they need income tax reform

to jump start the economy, what they mean is they need to lower the top rates for the one percent which includes lowering the capital gains tax. In 1977 the maximum capital gains rate (long term) was 39.75 percent and by 2009 the maximum rate was 15.35 percent. Influence can - and does work.

Of course the top one percent does have a valid complaint that they pay an estimated 30 percent of all taxes (in 2013). And it is also estimated that the top 10 percent pay 66 percent of all taxes. While that may seem extreme, remember that the top 10 percent of U.S. earners control two-thirds of American wealth, thatís around 66 percent.

Remember the venture capitalist Mr. Tom Perkins, who compared equated the treatment of wealthy people in America to the Nazi attacks on Jews just before the Holocaust. That same Mr. Perkins recently was in the news again. This time Mr. Perkins believes that people that do not pay taxes should not vote. As he said, "The Tom Perkins system is: You donít

get to vote unless you pay a dollar of taxes," He also added, "But what I really think is, it should be like a corporation. You pay a million dollars in taxes, you get a million votes. How can a billionaire be so un-informed? Normal billionaires already have a return that exceeds our votes. They get what they want not by popular choice, but because of what they can buy

elections, I mean contribute to elections.

Trickledown economics does work, if you are rich. You would think that Mr. Perkins, who is a billionaire, would already know that the redistribution of the wealth has already occurred.

Read other articles by Shannon Bohrer